Master Accrued Revenue Accounting: A Quick Guide

Accrued revenue accounting is a critical concept for businesses aiming to maintain accurate financial records and ensure compliance with accounting standards. Whether you’re a small business owner or a finance professional, understanding how to recognize and record revenue before it’s received is essential. This guide will walk you through the fundamentals of accrued revenue accounting, providing actionable insights to streamline your financial processes. From defining accrued revenue to implementing best practices, you’ll gain the knowledge needed to master this accounting principle. (accrued revenue accounting, revenue recognition, financial compliance)

What is Accrued Revenue Accounting?

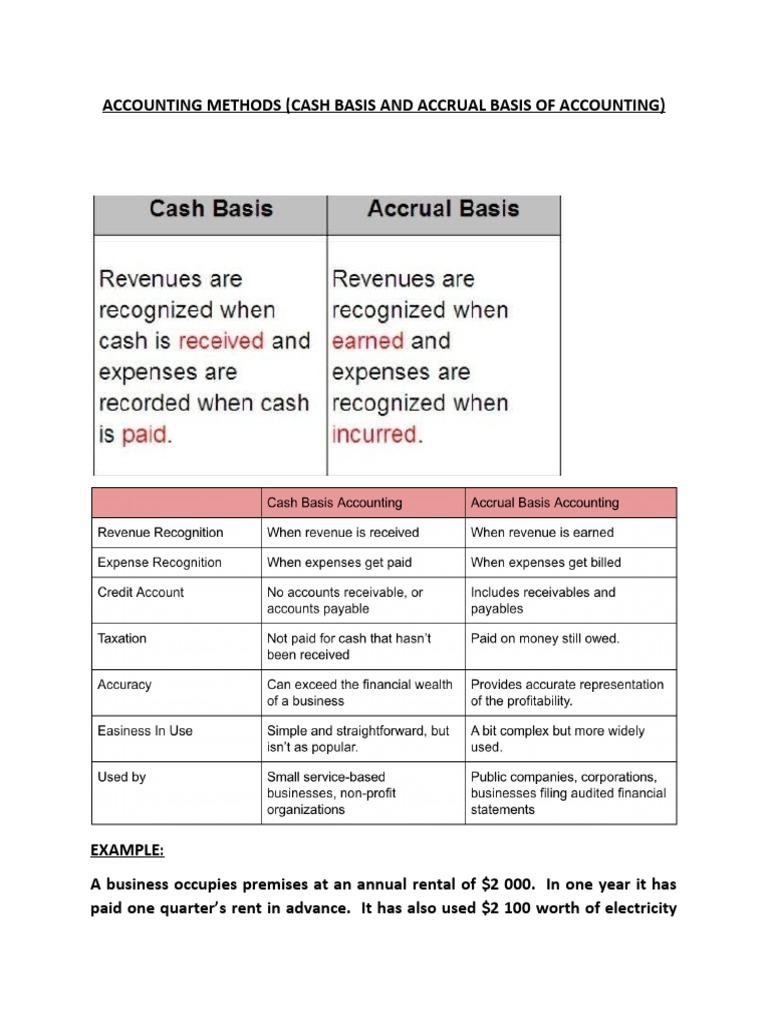

Accrued revenue refers to income that a company has earned but has not yet received payment for. This concept is a cornerstone of accrual accounting, which recognizes revenue when it’s earned, not when cash is exchanged. For example, if a consulting firm completes a project in December but invoices the client in January, the revenue is accrued in December. Understanding this principle ensures your financial statements reflect the true financial position of your business. (accrual accounting, revenue recognition principles)

Why is Accrued Revenue Accounting Important?

Properly managing accrued revenue is vital for several reasons. First, it ensures compliance with accounting standards like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Second, it provides a more accurate snapshot of your company’s financial health. Lastly, it helps in forecasting cash flow and making informed business decisions. Ignoring accrued revenue can lead to distorted financial statements and misinformed strategic planning. (GAAP, IFRS, financial health)

How to Record Accrued Revenue

Recording accrued revenue involves a straightforward process. Follow these steps:

- Identify Earned Revenue: Determine the revenue earned but not yet billed.

- Create a Journal Entry: Debit an asset account (e.g., Accounts Receivable) and credit a revenue account (e.g., Service Revenue).

- Reverse the Entry Upon Payment: Once payment is received, reverse the accrual to avoid double-counting revenue.

📌 Note: Consistency in recording accrued revenue is key to maintaining accurate financial records.

(journal entry, accounts receivable, financial records)

Best Practices for Accrued Revenue Accounting

To master accrued revenue accounting, consider these best practices:

- Use Accounting Software: Tools like QuickBooks or Xero can automate accrual entries and reduce errors.

- Regularly Reconcile Accounts: Ensure accrued revenue aligns with actual payments received.

- Train Your Team: Educate your finance team on accrual accounting principles to avoid mistakes.

(accounting software, QuickBooks, Xero)

Common Mistakes to Avoid

Even seasoned professionals can make errors in accrued revenue accounting. Watch out for:

- Failing to Reverse Accruals: Forgetting to reverse entries once payment is received can inflate revenue.

- Inconsistent Timing: Accruing revenue at the wrong time can distort financial statements.

- Ignoring Documentation: Lack of proper documentation can lead to audit issues.

(financial statements, audit issues)

Checklist: Accrued Revenue Accounting Essentials

- Identify all revenue earned but not yet billed.

- Create accurate journal entries for accrued revenue.

- Reverse accruals upon receiving payment.

- Reconcile accounts regularly to ensure accuracy.

- Use accounting software to streamline processes.

Mastering accrued revenue accounting is essential for maintaining accurate financial records and ensuring compliance with accounting standards. By understanding the principles, recording revenue correctly, and avoiding common mistakes, you can enhance your financial management practices. Implement the best practices and checklist provided to streamline your accounting processes and make informed business decisions. (financial management, accounting standards, business decisions)

What is the difference between accrued revenue and accounts receivable?

+

Accrued revenue is income earned but not yet billed, while accounts receivable is income billed but not yet received. Both are assets but represent different stages of the revenue cycle.

How does accrued revenue affect cash flow?

+

Accrued revenue doesn’t directly impact cash flow since it’s non-cash income. However, it helps in forecasting future cash inflows when payments are received.

Can accrued revenue be negative?

+

No, accrued revenue cannot be negative. It represents income earned, which is always a positive value. A negative balance would indicate an error in accounting.