Alaska Paycheck Calculator: Calculate Your Take-Home Pay Fast

Understanding your take-home pay is crucial for financial planning, especially in a state like Alaska with its unique tax structure. Whether you’re a resident or considering a move, our Alaska Paycheck Calculator simplifies the process, helping you estimate your net income accurately.

How Does the Alaska Paycheck Calculator Work?

The calculator uses your gross income, pay frequency, and withholding allowances to determine your take-home pay. It accounts for federal, state, and local taxes, as well as deductions like Social Security and Medicare.

Key Features of the Calculator

- User-Friendly Interface: Input your details and get instant results.

- Accurate Tax Calculations: Reflects Alaska’s tax laws, including its lack of state income tax.

- Customizable Inputs: Adjust for overtime, bonuses, or additional deductions.

💡 Note: Alaska does not impose a state income tax, which can significantly increase your take-home pay compared to other states.

Steps to Use the Alaska Paycheck Calculator

- Enter Your Gross Income: Include all earnings before deductions.

- Select Pay Frequency: Choose from weekly, bi-weekly, monthly, etc.

- Adjust Withholdings: Modify federal allowances or additional deductions.

- Review Results: See your estimated net pay and breakdown of deductions.

Why Use an Alaska Paycheck Calculator?

- Budgeting: Plan expenses based on your actual income.

- Tax Planning: Understand how deductions impact your pay.

- Comparison: Compare Alaska’s take-home pay with other states.

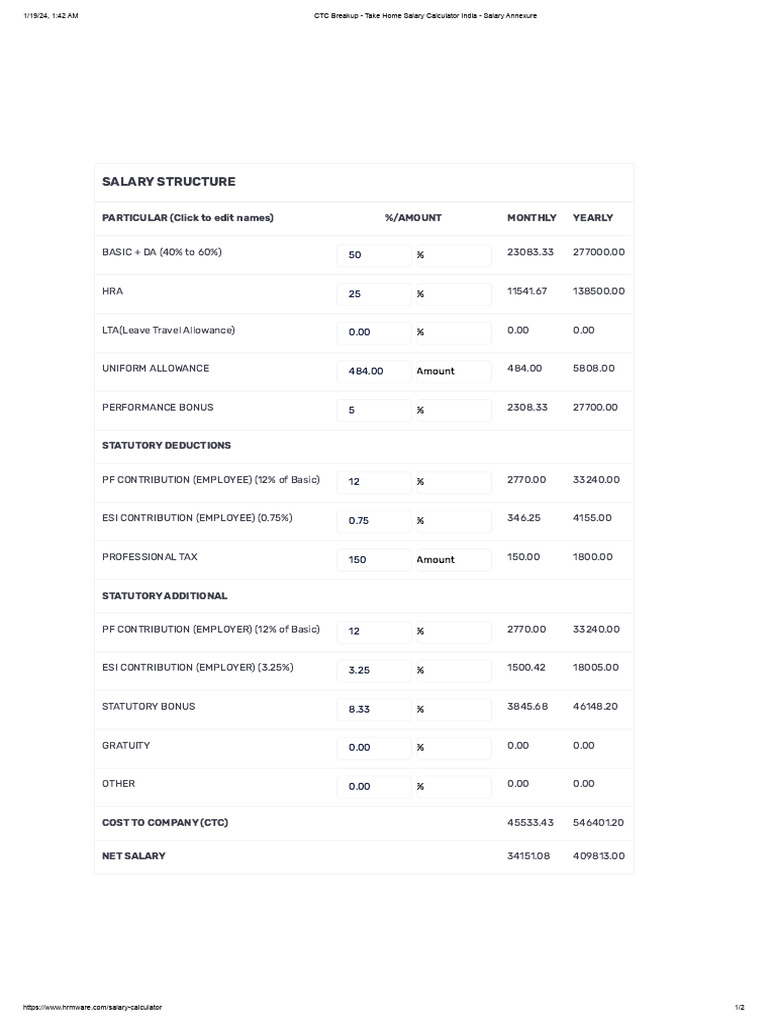

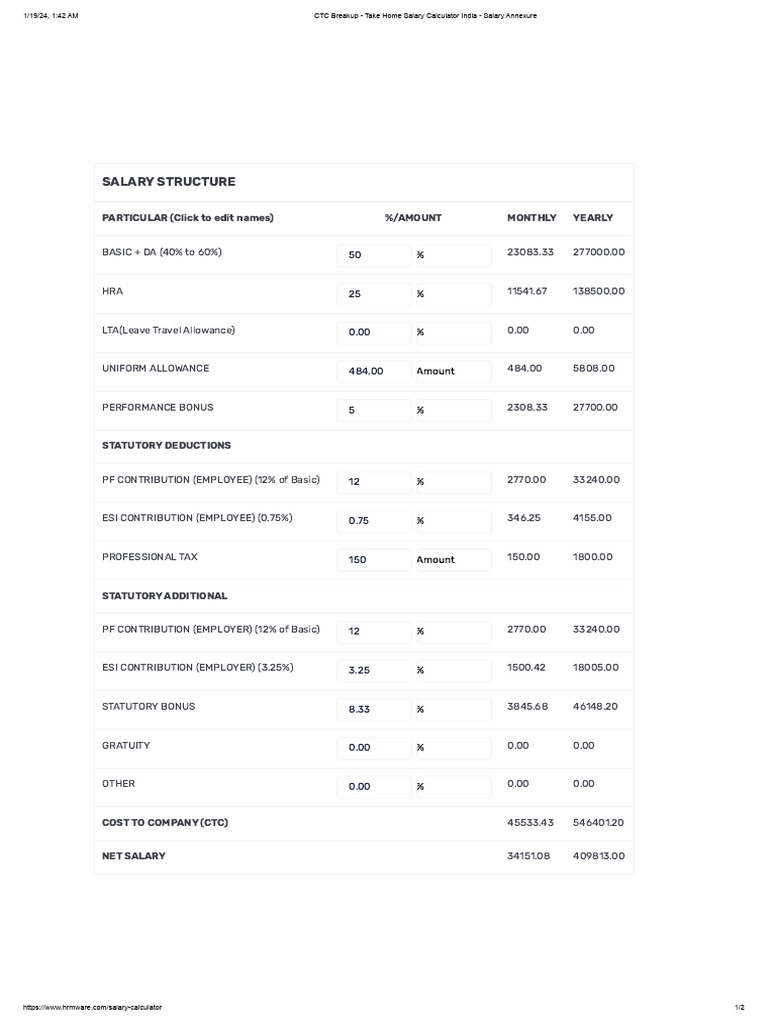

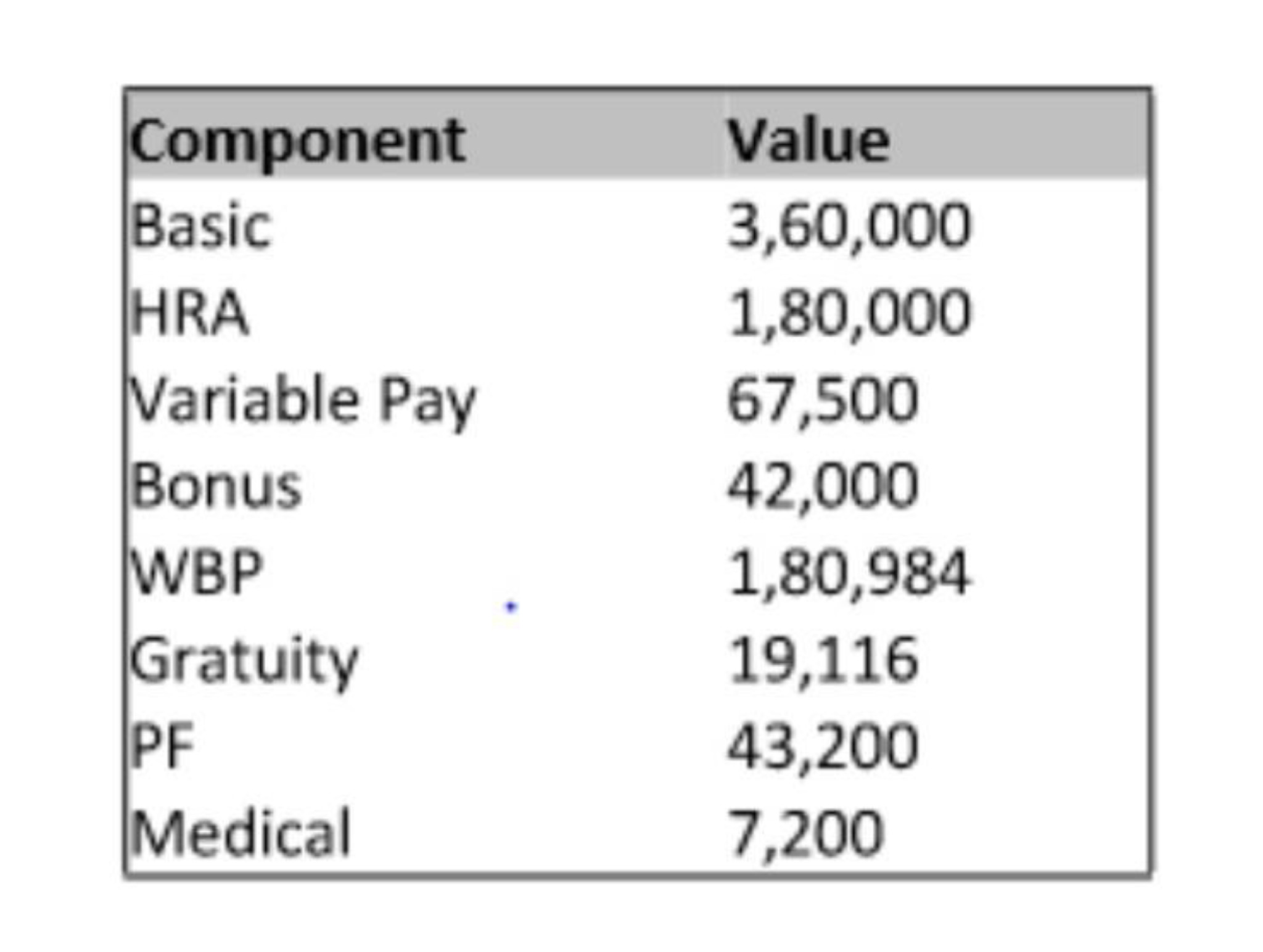

Factors Affecting Your Alaska Paycheck

- Federal Taxes: Based on your income and filing status.

- FICA Taxes: Social Security and Medicare deductions.

- Pre-Tax Deductions: Contributions to retirement plans or health insurance.

| Deduction Type | Percentage/Amount |

|---|---|

| Federal Income Tax | Varies by income |

| Social Security | 6.2% |

| Medicare | 1.45% |

Checklist for Using the Alaska Paycheck Calculator

- [ ] Gather your gross income and pay frequency.

- [ ] Verify your federal withholding allowances.

- [ ] Include any pre-tax deductions or additional income.

- [ ] Review the net pay breakdown for accuracy.

📌 Note: Regularly update your calculator inputs if your income or deductions change.

Understanding your take-home pay in Alaska is essential for effective financial management. With no state income tax, your net pay may be higher than in other states. Use our Alaska Paycheck Calculator to estimate your earnings accurately and plan your budget with confidence.

Does Alaska have state income tax?

+No, Alaska does not impose a state income tax, making it one of the few states without this tax.

What deductions are included in the calculator?

+The calculator includes federal taxes, FICA taxes (Social Security and Medicare), and optional pre-tax deductions.

Can I use the calculator for hourly wages?

+Yes, input your hourly rate and hours worked to calculate your take-home pay.

Alaska paycheck calculator, Alaska take-home pay, Alaska tax deductions, paycheck calculator tool