Calculate Take Home Pay in Michigan Easily

Understanding your take-home pay in Michigan is crucial for budgeting and financial planning. With various taxes and deductions, calculating your net income can be complex. This guide simplifies the process, ensuring you know exactly how much you’ll receive in your paycheck. Whether you’re a Michigan resident or planning to move, this step-by-step guide will help you calculate take-home pay in Michigan accurately.

How to Calculate Take-Home Pay in Michigan

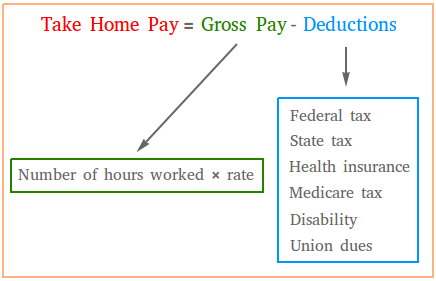

To calculate take-home pay in Michigan, you need to account for federal and state taxes, Social Security, Medicare, and other deductions. Below is a breakdown of the process:

Step 1: Determine Your Gross Income

Your gross income is your total earnings before any deductions. This includes your salary, wages, bonuses, or commissions.

📌 Note: Ensure you have your latest pay stub or employment contract for accurate figures.

Step 2: Calculate Federal Income Tax

Federal income tax is based on your taxable income and filing status. Use the IRS tax brackets to determine your federal tax liability.

Step 3: Calculate Michigan State Income Tax

Michigan has a flat state income tax rate of 4.25%. Multiply your taxable income by this rate to find your state tax deduction.

Step 4: Deduct Social Security and Medicare

Social Security (6.2%) and Medicare (1.45%) are deducted from your gross income. These are federal payroll taxes.

Step 5: Account for Other Deductions

Other deductions may include health insurance, retirement contributions, or garnishments. Subtract these from your gross income.

Using a Take-Home Pay Calculator in Michigan

For a quicker solution, use an online take-home pay calculator in Michigan. These tools automatically apply tax rates and deductions based on your input, providing an instant estimate of your net pay.

📌 Note: Always double-check the calculator’s accuracy by comparing it with manual calculations.

Key Factors Affecting Take-Home Pay in Michigan

Several factors influence your net income:

- Tax Filing Status: Single, married, or head of household.

- Dependents: Credits for children or other dependents.

- Pre-Tax Deductions: Contributions to retirement plans or health savings accounts.

Checklist for Calculating Take-Home Pay in Michigan

- [ ] Gather your gross income details.

- [ ] Determine federal and state tax liabilities.

- [ ] Calculate Social Security and Medicare deductions.

- [ ] Subtract additional deductions (insurance, retirement, etc.).

- [ ] Verify your net pay using a calculator or manual method.

Final Thoughts

Calculating your take-home pay in Michigan doesn’t have to be overwhelming. By following these steps or using a reliable calculator, you can accurately estimate your net income. Understanding your paycheck ensures better financial planning and peace of mind.

What is Michigan's state income tax rate?

+Michigan has a flat state income tax rate of 4.25%.

How do I calculate federal income tax in Michigan?

+Use the IRS tax brackets based on your taxable income and filing status.

Can I use a take-home pay calculator for Michigan?

+Yes, online calculators can provide quick estimates, but always verify the results.

calculate take-home pay in Michigan, take-home pay calculator in Michigan, Michigan state income tax, federal income tax in Michigan